KNOWLEDGE CENTER: For Employers

Research shows that employee engagement, participation and satisfaction with their retirement benefits are directly tied with how well they understand their plan and their investments. That's why we opened the Knowledge Center, an online resource for educational materials, videos, and a variety of seminars/webinars to assist plan sponsors and business owners with providing education to employees. Browse the content below and be sure to check back regularly as we are always updating our online resources.

The Library

Four Tax Stratrgies For Employers

As an employer, choosing to offer a 401(k) plan can benefit your employees. Did you know it can also benefit you?

DownloadIs your plan getting the support it needs during this pandemic?

Is your plan getting the support it needs during this pandemic?

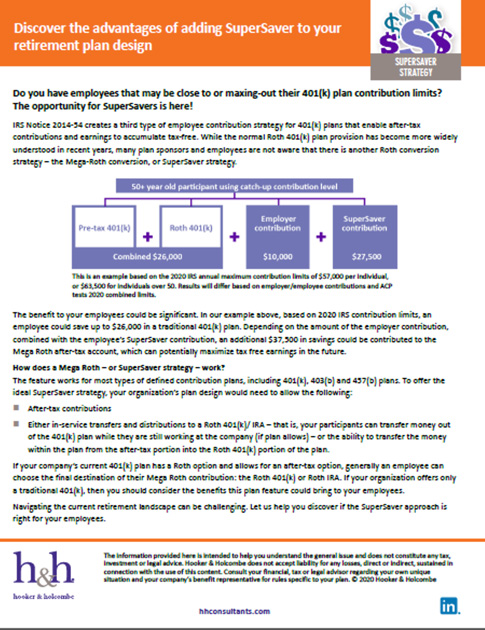

DownloadDiscover the advantages of adding SuperSaver to your retirement plan design

Learn how this exciting, low-cost plan amendment may be able to benefit your employees.

DownloadGuiding the fiduciary oversight process in 5 steps

Understanding fiduciary responsibility is key for plan sponsors and retirement plan committee members.

DownloadThe link between employee productivity, health, and financial stress

Recent research has proven there is a direct link between financial stress and company productivity.

DownloadCoronavirus and Retirement Savings

COVID-19 is wreaking havoc on financial markets, both in the U.S. and abroad. However, by looking back in time, we might be able to educate and inform investor actions today.

DownloadWhat are corrective distributions and how to avoid them going forward

Non-discrimination testing is an important part of sponsoring a 401(k) plan, but it shouldn’t cause an employer undue stress.

DownloadLawsuits over the years and what it means for plan sponsors

The barrage of excessive fee lawsuits filed in 2006 started a trend that continues to this day.

DownloadShould you include ESG funds in your retirement plan?

ESG, or environmental, social and governance funds, can be appealing to many investors, including millennials.

DownloadOur 401(k) investments are on the watch list. Now what?

Approach, review, document, and decide

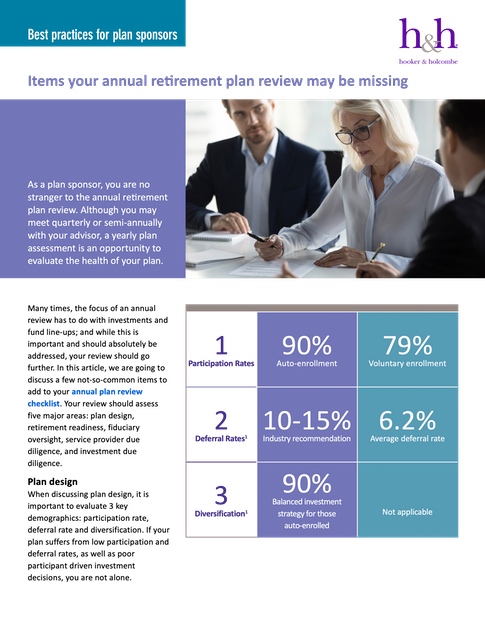

DownloadItems your annual retirement plan review may be missing

As a plan sponsor, you are no stranger to the annual retirement plan review.

Download90 - 10 - 90 rule

If you, your plan or your participants suffer from poor participation, low deferral rates or shortsighed investment decisions, you are not alone.

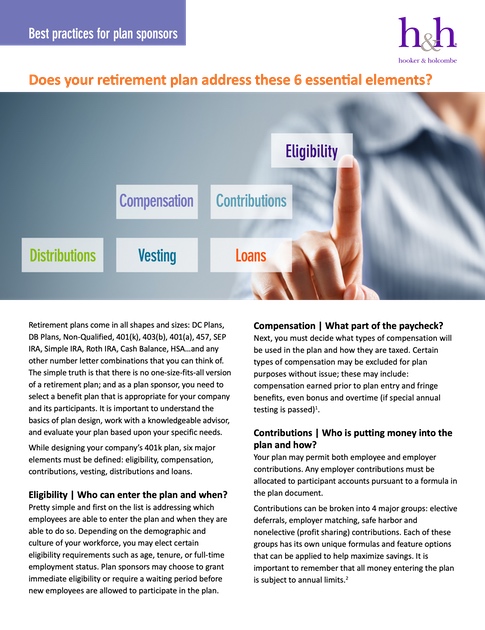

DownloadDoes your retirement plan address these 6 essential elements?

Retirement plans come in all shapes and sizes: DC Plans, DB Plans, Non-Qualified, 401(k), 403(b), 401(a), 457, SEP IRA, Simple IRA, Roth IRA, Cash Balance, HSA…and any other number letter combinations that you can think of.

DownloadCyber-attacks are on the rise. Is your retirement plan protected?

Cyber-crime is on the rise worldwide.

DownloadRetirement plan share classes: Understanding the basics

Choosing mutual funds for your retirement plan’s investment lineup can feel like wading through a sea of alphabet soup.

DownloadBenchmarking your plan is about more than just fees and expenses

It’s about helping you identify opportunities, achieving greater employee outcomes and minimizing your fiduciary risk.

DownloadRisky business: Why plan governance matters

In today’s continually-evolving regulatory and legal environment, it’s more important than ever to make sure your organization’s retirement plan is both effective and compliant.

DownloadFour tips to boost your employees’ retirement outlook

As many employees look ahead to retirement, 47% of workers feel somewhat confident that they’ll have enough money saved to retire on time and then live comfortably.

DownloadUnderstanding House Bill 7161 and its impact on your 403(b) plans

Connecticut passed an act that will bring non-ERISA 403(b) plans closer to ERISA 403(b) plans. The new law is the first in the country to require a much higher level of fiduciary standards for these types of plans.

DownloadChoosing the best fee allocation model for your 401(k) plan

We all know that paying for the administration of a retirement plan adds an expense to the bottom line.

DownloadPart 2: The best retirement packages for your HCEs

Now that you've engaged your employees in participation, discover how to optimize their plan under HCE rules.

DownloadPart 1 : Engaging HCE plan participation

Are your most vital employees saving enough for retirement? Ensure that the retirement plans you sponsor are effective and attractive to high-value employees.

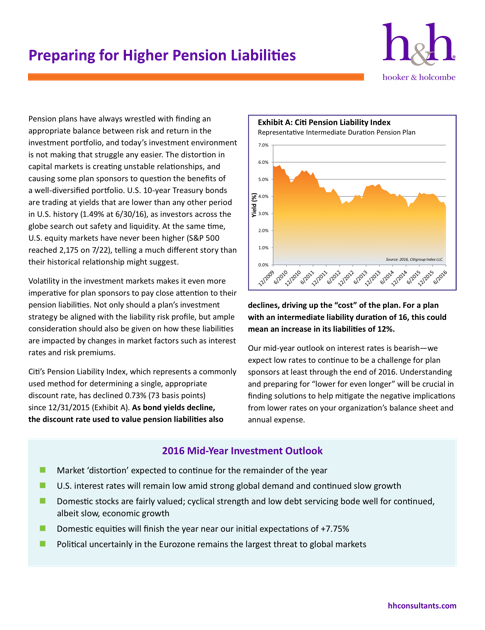

DownloadPension Liabilities

Pension plans have always wrestled with finding an appropriate balance between risk and return in the investment portfolio, and today's investment environment is not making that struggle any easier.

DownloadDOL Fiduciary Rule

In 2016, the Department of Labor issued the final version of its Fiduciary Rule. This new rule is the single biggest change affecting the way investment advisors provide advice to retirement plans since ERISA was introduced in 1974.

DownloadDo Retirement Plans Without Limits Make Sense for Your Bank's Executives?

Since the passage of ERISA in 1974, plan sponsors have been trying to balance the delivery of retirement benefits (defined benefit or defined contribution) between qualified and nonqualified plans. A fundamental objective of either a qualified or nonqualified plan is the deferral of taxes.

DownloadWhat the Fiduciary Are you Talking About?

Since the passage of ERISA in 1974, plan sponsors have been wrestling with who is and who is not a fiduciary of their retirement benefit plans while also making sure that a plan must have at least one fiduciary named in the plan document.

DownloadCBIA Benefits Survey (13th Edition)

CBIA’s Benefit Survey Report contains information submitted by 297 companies throughout Connecticut. The report is divided into three sections: time off; health and other insurance benefits; and retirement benefits.

DownloadCBIA's Executive Compensation Report (8th Edition)

This, the eighth annual survey of compensation and benefits for Connecticut’s top executives, contains information on base salary, total compensation, incentives (short- and long-term), and benefits related to executive compensation.

DownloadSuccess Stories

Pension Information Manager - Case Study

Learn how we helped one client administer the plan while focusing on other HR-related responsibilities.

DownloadLowering municipal pension costs through cash balance plan design

Learn how we helped one CT town with this innovative alternative that would curb rising pension costs.

DownloadActuarial services are the talk of the town

Our innovative ‘opt-out’ pension plan design gave this town a solution to talk about.

DownloadNew ways to save money during union negotiations

To help this municipal client reduce employee benefit costs, we built an innovate testing solution that proved significant savings over a 20-year period.

DownloadStrategic 403(b) solutions optimize plan savings

Discover how a modernized investment strategy motivated employees to join the plan or increase savings, and achieved significant saving for both the client and plan participants.

DownloadNot-for-profit school & foundation

From benchmarking studies to streamlined plans, our retirement and investment services score an A+

DownloadPlan consolidation to get fueled up over

Learn how creating a modern plan structure for this convenience store and fuel retailer led to a more manageable plan and clearer understanding of its features for employees

DownloadRetirement education to forge ahead

This metal manufacturer is giving employees a better understanding of their retirement plan.

Download