KNOWLEDGE CENTER: For Employees

We believe in empowering individuals to take ownership of their financial future. That's why we created the Knowledge Center, a collection of learning materials and tools designed to help individuals - both novice and savvy - plan for a solid financial future. Browse the content below but be sure to check back regularly as we are always updating our online resources.

The Library

Financial Wellness - Be better prepared for tomorrow — while still enjoying today

Financial wellness is about achieving a healthy balance between living for today while preparing for tomorrow.

DownloadFive Ways to Maximize Your 401(k) Benefits

There’s never a bad time to learn what you can do to maximize the tax benefits you receive from participating in an employer-sponsored 401(k) plan. We offer these five easy tips to ensure you’re making the most of your workplace retirement plans.

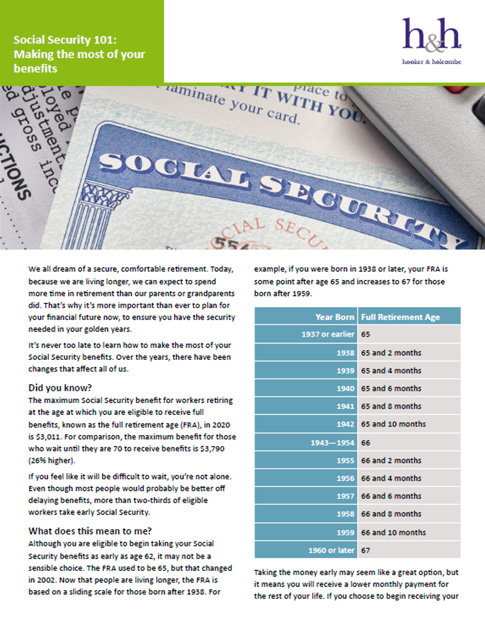

DownloadSocial Security 101: Making the Most of Your Benefits

We all dream of a secure, comfortable retirement. Today, because we are living longer, we can expect to spend more time in retirement than our parents or grandparents did.

DownloadThe Value of Professional Financial Planning

Your dollars can add up fast once you start tackling debt. Use this 3-step guide to get started.

DownloadCOVID-19 relief for federal student loan borrowers

Recently passed CARES Act offers some relief for those with federal student loans.

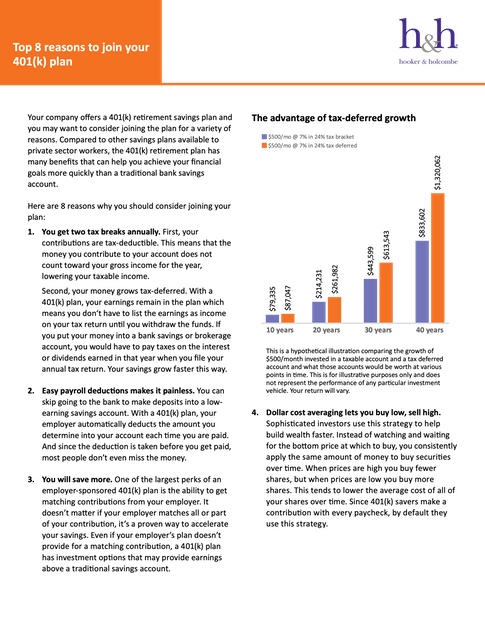

DownloadTop 8 reasons to join your 401(k) plan

When compared with other savings plans the 401(k) retirement plan has many benefits.

DownloadBeware of Phishers during COVID-19

Remember to be vigilant about suspicious emails. The chaos created by COVID-19 is being used by Phishers to try and gain access to your personal information.

DownloadProtecting your retirement account and identity against cybercrime

Identity thieves and other criminals are increasingly targeting retirement accounts instead of more traditional targets such as credit cards. Because of this trend, it’s more important than ever to make sure that your account and personal data are secure.

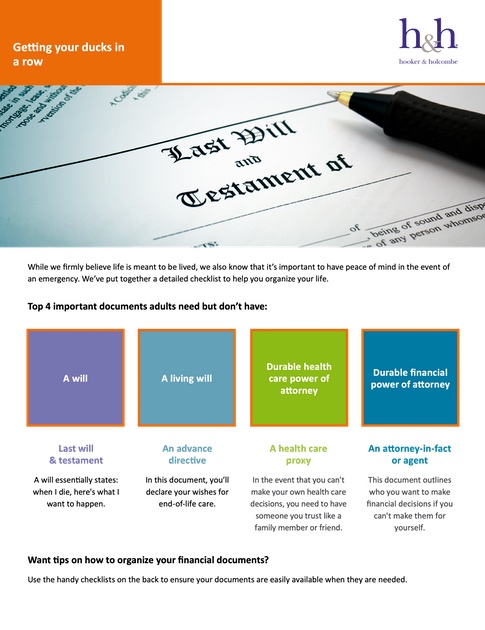

DownloadGetting your ducks in a row

Taking the time to gather and share important documents with trusted family and friends is essential to ensuring your peace of mind in the event of an emergency.

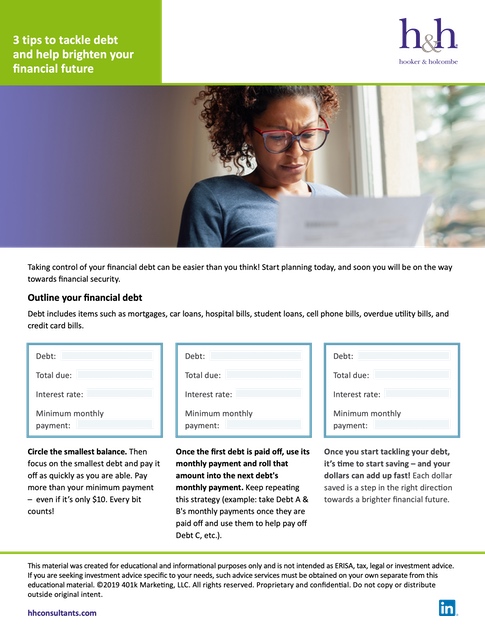

Download3 tips to tackle debt and help brighten your financial future

Your dollars can add up fast once you start tackling debt. Use this 3-step guide to get started.

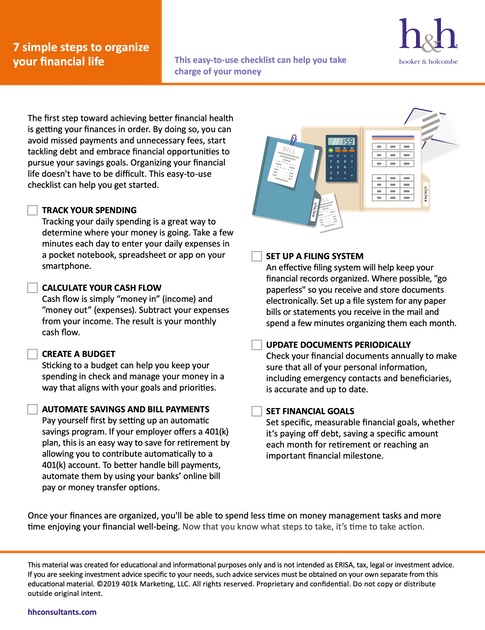

Download7 simple steps to organize your financial life

This easy-to-use checklist can help you take charge of your money

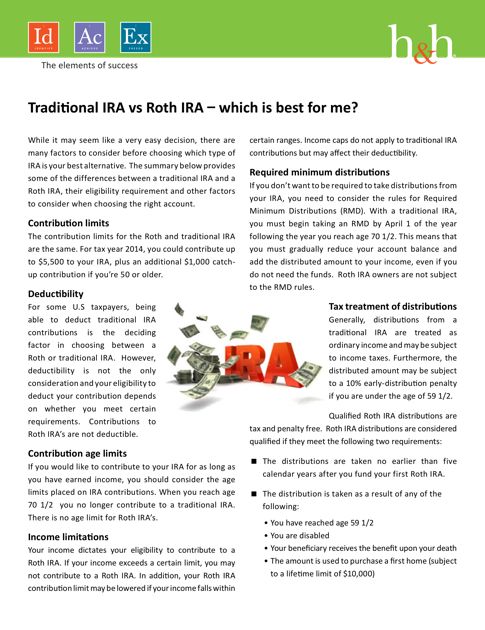

DownloadTraditional IRA vs Roth IRA—which is best for me?

While it may seem like a very easy decision, there are many factors to consider before choosing which type of IRA is your best alternative.

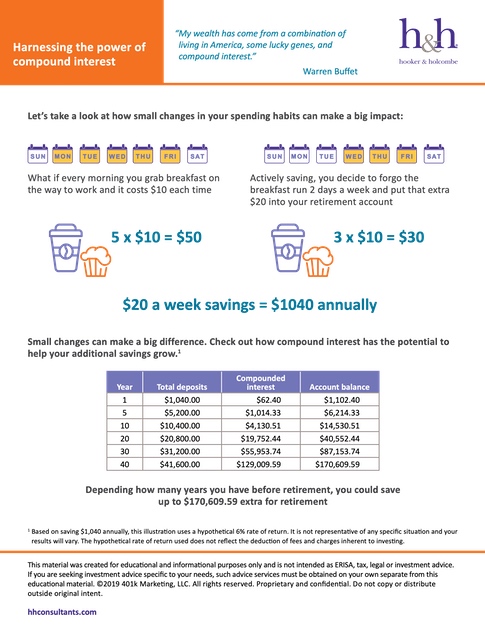

DownloadHarnessing the power of compound interest

Take a look at how small changes in your spending habits can make a big impact.

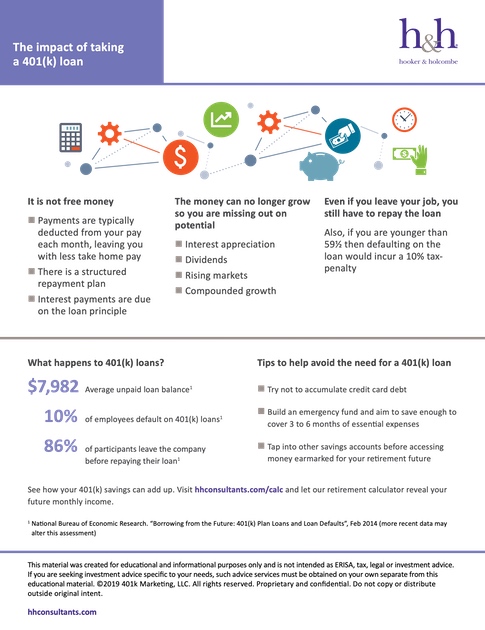

DownloadThe impact of taking a 401(k) loan

Help guide your participants in the right direction by sharing this article with them.

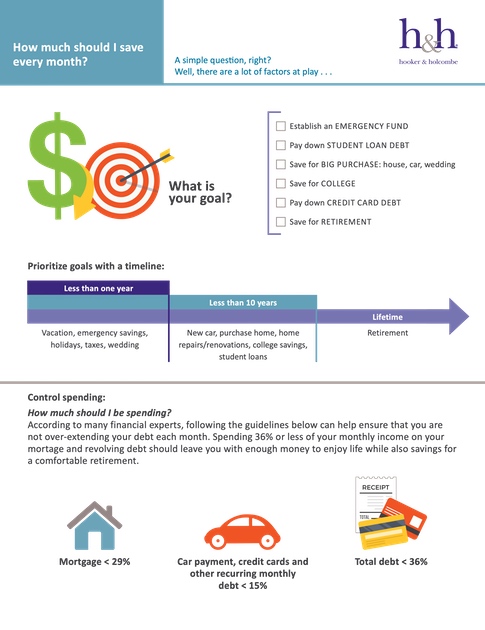

DownloadHow much should I save every month?

A simple question, right? Well there are a lot of factors at play...

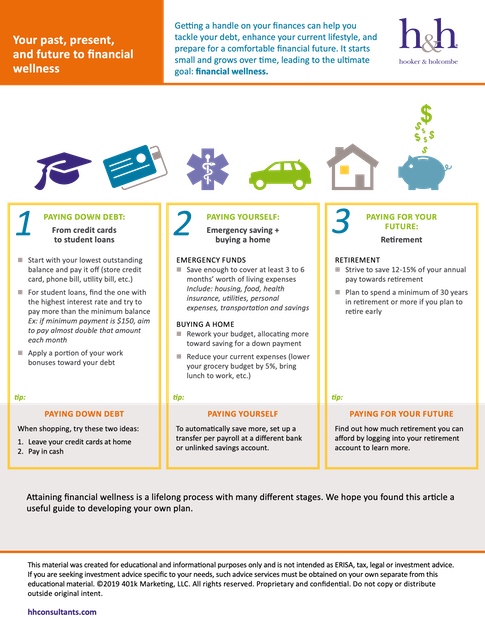

DownloadYour past, present, and future to financial wellness

Getting a handle on your finances can help you tackle your debt, enhance your current lifestyle, and prepare for a comfortable financial future.

DownloadSummer Reading

Starting in the middle of the 20th century, the world of finance and investing became more popular and consequently, so too did books on the subject.

DownloadTeaching Kids About Money

Financial literacy is one of the most important lessons you can impart on your children to make them successful in adulthood.

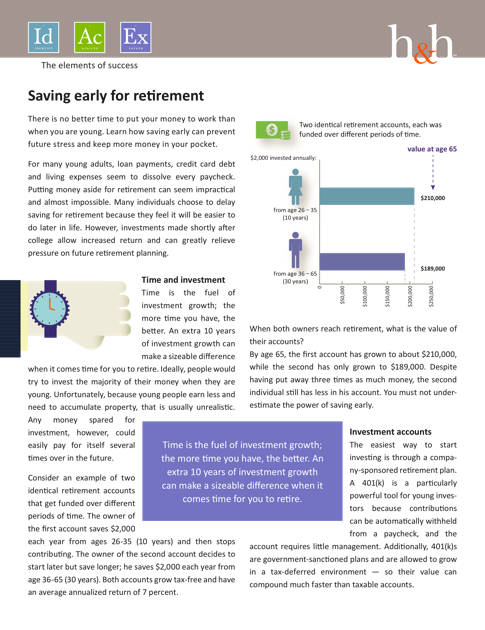

DownloadSaving Early for Retirement

There is no better time to put your money to work than when you are young. Learn how saving early can prevent future stress and keep more money in your pocket.

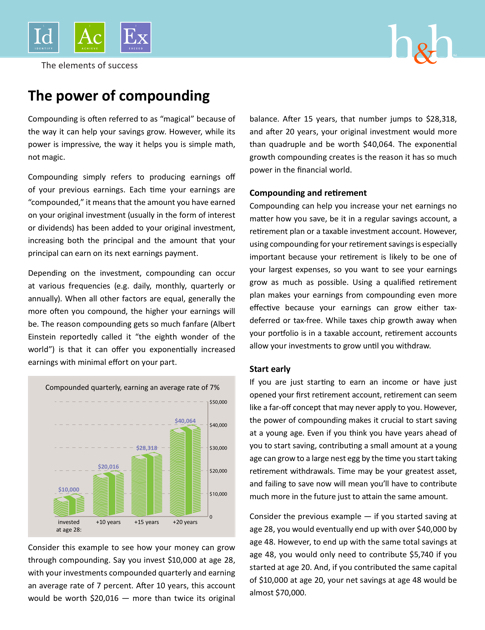

DownloadThe Power of Compounding

Compounding is often referred to as "magical" because of the way it can help your savings grow. However, while its power is impressive, the way it helps you is simple math, not magic.

DownloadThe Tax Advantages of Funding Higher Education

Depending on the adjusted gross income of your family and other criteria you may be entitled to a tax refund of up to $2,500. Learn if you qualify for either of these programs.

DownloadExplore Your Rollover Options

You’ve decided to make a change in employment. Now you need to decide what to do with the 401(k) or 403(b) plan that you have with your former employer.

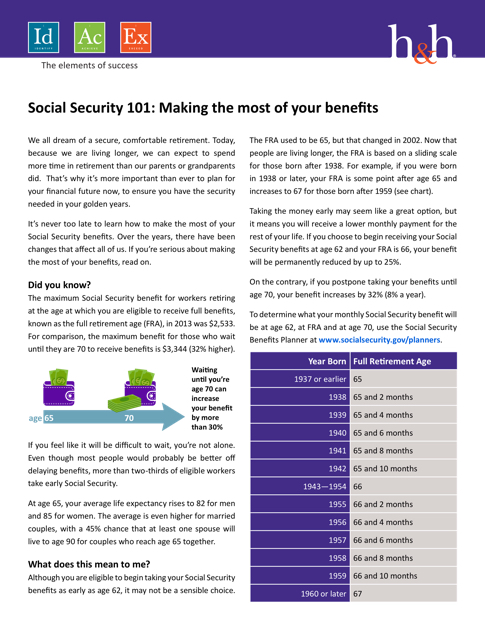

DownloadSocial Security 101: Making the Most of Your Benefits

Because we are living longer, we can expect to spend more time in retirement than our parents or grandparents did. That’s why it’s more important than ever to plan for your financial future now, to ensure you have the security needed in your golden years.

DownloadPros and Cons of Target-Date Funds

Rebalancing your portfolio as you near retirement goes undone for many investors each year. From not knowing how or if you should to being unable to decide on the best asset allocation for their age, target date funds attempt to solve this problem.

DownloadThe Value of Professional Financial Planning

Learn how professional financial planning can help you reduce your money stress and safeguard your financial future.

DownloadFive Ways to Maximize Your 401(k) Benefits

There’s never a bad time to learn what you can do to maximize the tax benefits you receive from participating in an employer-sponsored 401(k) plan. We offer these five easy tips to ensure you’re making the most of your workplace retirement plans.

DownloadUnderstanding Required Minimum Distributions

After years saving for retirement and allocating non-taxed dollars into retirement savings, the time will come when you have to pay tax on that money. Learn about Required Minimum Distributions and how to be sure you are satisfying IRS requirements.

Download